July 2021: QuickBooks Online Pricing Changes

QUICKBOOKS ONLINE (QBO) PRICING CHANGES

QuickBooks Online (QBO) is changing its pricing policy. Here is what you need to know.

Historically, we have been able to offer QBO subscriptions at a wholesale discount through our firm billing. This is the same discount we as a firm receive from Intuit, and we simply pass the same price through to you as our clients to provide you with this additional value-added benefit. While we will continue to share this discount with you under the same approach, Intuit has recently announced base price changes to QBO as follows:

- QuickBooks Online Essentials will increase from $40 to $50 per month

- QuickBooks Online Plus will increase from $70 to $80 per month

- QuickBooks Online Advanced will increase from $150 to $180 per month

Intuit did not make changes to QBO Self-Employed or Simple Start subscription prices.

These price changes are applicable to new and existing subscriptions. According to Intuit, Intuit has updated pricing in order to re-invest in its product development to provide more value to users. Intuit is also working to develop its QBO support team, to more quickly assist users who are calling in for QBO support.

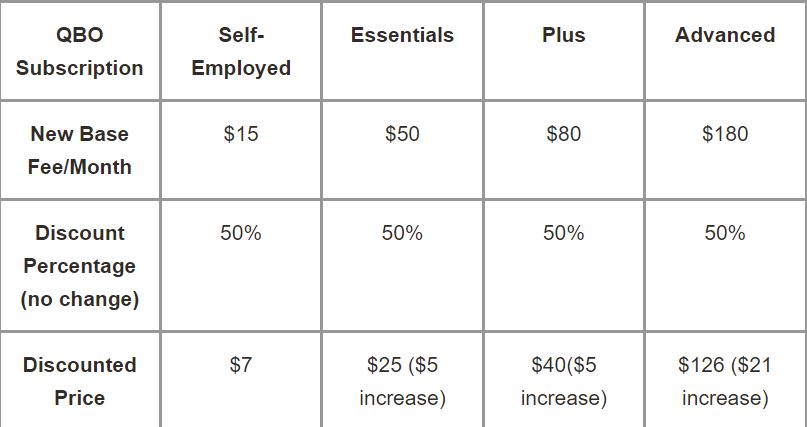

While we will continue to pass this discount through to you, we wanted to communicate Intuit’s increased monthly base prices to you. For those of you who are currently participating in our discount for QBO, or register with us by July 14, 2021, and wish to continue, these price changes will take effect on September 1, 2021, as follows:

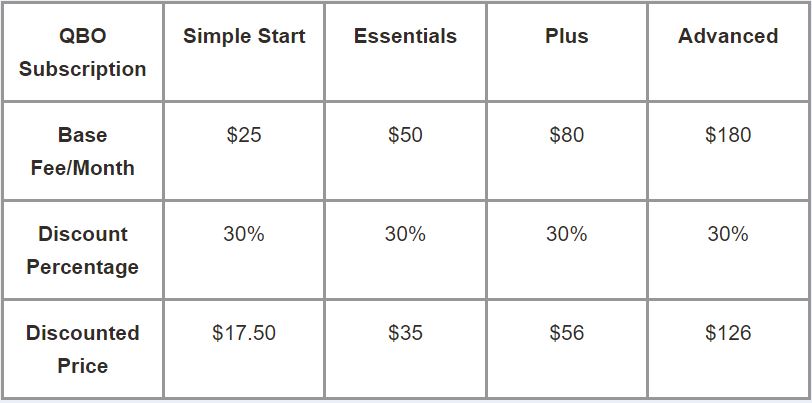

If you have not participated in our discount and would like to, here are the monthly prices available to you if you register on or after July 15, 2021:

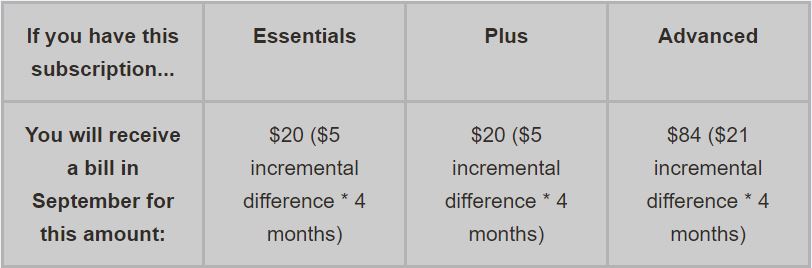

IMPORTANT NOTE ON BILLING: For those of you who are currently participating in our discount, we bill you one time each year for the subscription to QBO. As we have already billed the full amount for QBO subscriptions in January of 2021, we will only bill the incremental difference of the increase from Inuit (plus sales tax) for September through December 2021 (please see chart below). Then, as normal, we will bill the full amount based on the new pricing (summarized above) offered by Intuit for the year 2022 in January of 2022.

If you are unsure of your subscription level, please feel free to log in to your QBO account and follow these steps:

1. Once on the main page, click on the settings wheel on the far upper right

2. Click on “Account and Settings” under My Company

3. Click on “Billing & Subscription” in the upper left, below Company

4. This screen will display your subscription level

5. Please feel free to give us a call if you need any assistance with this!

We understand that increased prices can be concerning, and wanted to share this with you so you could be aware of Intuit’s changes. Please note, we do not profit from this and simply offer these wholesale subscriptions available to us as a benefit to you to better serve your business. As always, please feel free to reach out to us with any questions or concerns.

Employee Spotlight | Jennifer Loomis

Jennifer joined Soukup, Bush & Associates, P.C. in January 2012. Since then, she has been working in private and public accounting for 16 years, responsible for such tasks as the preparation of financial statements, payroll and payroll tax returns, accounts payable and receivable, and other bookkeeping roles. Before coming to Soukup, Bush and Associates, she worked full time for a public accounting firm for 6 1/2 years and was most recently working as a corporate accountant for a private company in Windsor. At the firm, she provides bookkeeping services to clients by preparing monthly financial statements, bank reconciliations, and quarterly and annual payroll tax returns. She is also a Certified Quickbooks Professional Advisor.

Jennifer enjoys spending time with her daughter Kaitlyn. She loves to travel to any tropical place and in the summer enjoys spending time outdoors boating and camping.

Filing Deadlines

SEPTEMBER 15, 2021 – Federal and state income tax returns are due for flow-through entities, including partnerships and S-Corporations if extended

SEPTEMBER 30, 2021 – Federal and state income tax returns are due for trusts if extended

OCTOBER 15, 2021 – Federal and state income tax returns are due for individual taxpayers and C-Corporations if extended

2021 ESTIMATED PAYMENT DEADLINES

SEPTEMBER 15, 2021 – 3rd quarter estimated payments for 2021 are due to the IRS and Colorado Department of Revenue